Friday the market price closed at $72.25 per barrel. The price of a barrel of oil has increase 17% in the last month. Four months ago the price per barrel was around $36. Here in California, gas prices have zoomed from $2.25 per gallon to $2.85 per gallon. Just in time for the driving summer season. What is happening?

First of all, oil went too high when it zoomed past $100 to $147 per barrel. There was no economic justification for oil going up so high. Speculators drove the market too high has everyone had to buy oil to make some money. When everyone is buying the same thing, you are nearing the peak price.

Oil usage dropped rapidly as gas cost over $4 per gallon. Mileage driven went down as people drove less, bought better mileage cars or took the public transit. This is a permanent change in behavior, and lowered usage more. Of course oil supplies rose. Then the price per barrel over-corrected into the 30’s. This happened despite cuts in production by OPEC. Demand fell faster due to a global recession.

But there are multiple situations affecting price. Developing countries like China and India are buying more cars. Oil stocks have fallen to normal levels. Bio-fuels have risen to be roughly 6% of consumption. Politically the Obama administration is not supporting drilling more oil domestically. Lower prices let that slide by without much political pressure, but I expect that to be a mistake as usage will increase worldwide. The energy alternatives for the green energy do not replace oil however. They generate electricity.

OPEC desires stability. They realize now too high of prices can stall the global economy reducing demand which ruins their economies. They recently increased production about 0.5% to stabilize demand.

So what is driving the price increases? The amount of money the government is borrowing and the policies of the treasury to fight the recession. The dollar is under pressure due to the debt levels and the value of the dollar will fall as the economy recovers. The Chinese and OPEC are looking to protect themselves by diversifying away from the dollar.

So what is my prediction? Oil will stay in the $50 - $80 range this year. Expect this bubble to deflate a bit by August. $3 per gallon gas is too big of a drag on the US economy to help the global economy recover. Second this should be a slow economic recovery. Oil usage is starting at a lower consumption rate for 2009 and 2010.

Long term the falling value of the dollar will be inflationary. US energy policies with global warming taxes will hurt energy independence for the next ten years. It will be cheaper to import oil than produce it domestically. Unless an energy break through occurs, expect oil prices to rise in the years 2011 - 2013.

Steve Amos

Subscribe to:

Post Comments (Atom)

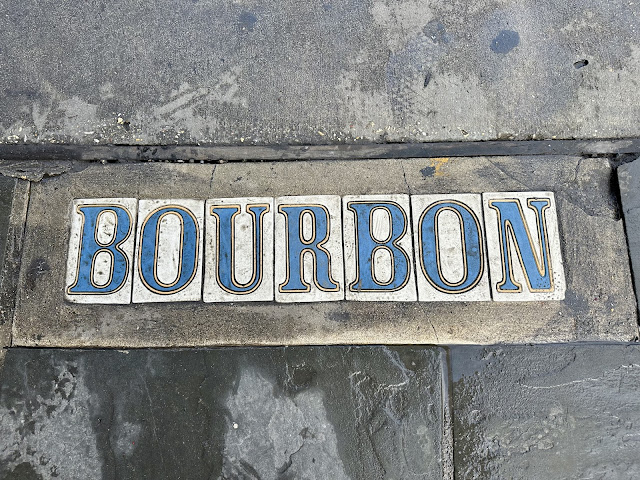

3:15 am attack on Bourbon Street, New Orleans this morning. This tragic attack killed 10 and injured ~35 including 2 police officers. Most...

-

"Be at war with your vices; at peace with your neighbors, and let every New Year find you a better man." - Benjamin Franklin ...

-

Being self-employed had to learn how to network. Being naturally shy it was difficult at first until learning these secrets. 1. Act as ...

-

Siding with Apple that developing new software to crack one phone will be reused all over the world. No fan of terrorist, but other govern...

No comments:

Post a Comment