Everyone makes a fool of themselves by predicting the future at this time of the year. So I will badly make a fool of myself by expressing my opinions on the difficult business market for 2008. Please be aware opinions do not affect the future, and your mileage will vary. So here we go…

Housing will drop big due to credit crunch. If you can’t get financing very easily, how do you buy from someone? Since it is harder to get loans, fewer buyers are available with good credit and money down to buy houses and condo. Investors buy at the value of the net income they can rent a property for, and look for bargains. Neither the lack of buyers and investors caution is good for supporting prices in housing.

Disclosure here: I have done residential and commercial real estate appraisal in California and assisted in Nevada, so actually have real estate analysis expertise. The rise in residential values ran 9 years in southern California from 1997 to 2006, and went years too far. Values could really drop back hard. Las Vegas and Arizona have already dropped prices around 30% and could go lower with so many new homes. The Inland Empire and San Diego values have dropped over 20% in 2007, so Los Angeles and Orange County are behind the curve and may fall 20% in 2008. I have predicted prices to fall off the peak 20% to 30%, and up to 50% if the economy really fell. So I tend to be regarded as pessimistic since I think the boom went far too long. Recovery should start around mid 2009 to 2010, but it is very hard to pick the bottom. If your housing prices have been falling since 2005 you are closer to the bottom than we are here in southern California.

Your area housing values will vary based on local conditions, but I expect a national average to fall by 10% without crazy loans, easy money and speculators to inflate home values. Best analysis I have read is from JP Morgan predicting land values will return to 2002 – 2003 levels, and near the east and west coasts the land may be up to 80% of home values. Location, location and location still rule when it comes to evaluating properties. Look for investment opportunities this year and in 2009.

Commercial property values will go down since it is harder to get credit here as well. It is early in this correction, locations, and property use varies so much will not predict how much values will fall. Commercial prices did not go up as crazily as they did in housing, but value depends on income and cost to borrow. A ten to twenty percent retreat would not surprise me this year in some areas.

Economy will recession early, and start the recovery before end of 2008. The credit crunch will hurt borrowing for businesses, but the hallmark of the American economy is how quickly capitalists adapt to change. China’s currency is increasing in value to the dollar, which will increase inflation as well. Consumers will cut back slightly, but most spending will continue to be stable. Styles will move away from excess to value, so imports may be hurt with higher prices of the now lower dollar. However booming economies internationally especially in India and China will improve American exports. In all, the diverse and adaptable economy will be recovering this year.

Employment will only drop mildly in the US. Finance, automobile and housing industries will be significantly hurt in 2008, but the rest of the economy should grow needing good employees. Your local conditions will vary. I will be looking for a new position in 2008, so understand personal concerns depend on your situation and industry. I expect to be with a business unit growing quickly or turning around by mid year.

Oil will fall from $90 – $100 per barrel to $60 – $70 per barrel in 2009. Politics in unstable countries can have a tremendous affect on supply making timetables hard to guess. So this is the riskiest prediction I am making. Have no special information here, but let’s look at history. Recently it took many years to go from $20 to $30 per barrel. Prices were stuck in the $15 to $20 range for over a decade. The sudden jump in oil prices from $30 to $90 per barrel happened way too quickly from a historical perspective. The cause was speculators and fears driving gains with increase international demand. The value of the dollar fell about 30% over the last few years, so $20 to $30 per barrel is now $30 to $45 per barrel. Demand will fall with current prices, and alternative sources are cost effective above $30 per barrel further reducing demand. Politics will have an effect with a president elect promising a program to reduce oil imports could speed the price reduction. Overall I expect a gradual reductions happening with jumps and falls starting in 2008.

Stock market will fall early and start recovery about mid 2008. The recovery will be mild and I like John Mauldin’s description of the “muddle through” economy. The stock market often acts as a predictor of the market and it has had a lot of growth. The question is how far we are going to correct recess or depress the market? More importantly which business sections are going to fall the most. My record here is poor historically, so do your own research. Falling should be finance companies, housing, and consumer related businesses. Everything else depends on design, innovation and value to grow businesses.

The election in November is too close to call right now. The Democrats are likely to have either Hilary or Obama, and they would be wise to have a joint ticket. Republicans have five good candidates, and possibly no one will come with a majority to the convention. Voters usually look at experience, positions, leadership and pandering. Could be another close election based on the experience of the Republican candidate versus the changes proposed by the Democrats. There is a lot of potential changes based on the economy, world events, Terrorists, Iraq and Afghanistan. In the final election the most moderate candidates between the Democrats and Republicans usually win, so that is my prediction.

Okay, this is enough predictions for me to reasonably make in 2008. Lets see how wrong I am since my record has never been perfect. Black swans events make predictions more of an art than a science. Use your own judgment about the validity of these guesses and how they may affect you.

Recommend Forbes, marketwatch.com, John Mauldin, Doug Fabian and Mark Skousen for research and information.

Subscribe to:

Post Comments (Atom)

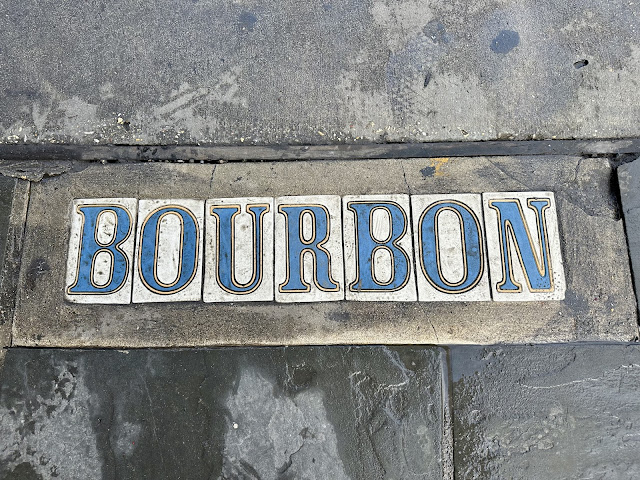

3:15 am attack on Bourbon Street, New Orleans this morning. This tragic attack killed 10 and injured ~35 including 2 police officers. Most...

-

"Be at war with your vices; at peace with your neighbors, and let every New Year find you a better man." - Benjamin Franklin ...

-

Siding with Apple that developing new software to crack one phone will be reused all over the world. No fan of terrorist, but other govern...

-

Being self-employed had to learn how to network. Being naturally shy it was difficult at first until learning these secrets. 1. Act as ...

No comments:

Post a Comment