It is time for the annual predictions of what the year will bring. So let’s look at my past predictions first.

• In 2009 I predicted the recession would continue, but not be a worldwide disaster.

[Partially Correct, not a worldwide disaster, but now is expanding worldwide]

• Jobs would be very hard to find, and would start recovering near the end of 2009.

[Correct, but the jobs recovery is barely starting]

• The stock market would bottom and start back up within 6 months.

[Correct bottoming in March]

• Housing predicted no bottom and prices would fall another 5% – 15%.

[Correct]

• Oil prices, thought we may have a correction where prices hit the $30’s per barrel, the stabilize around the $40’s to $60’s range.

[Partially Correct, did drop into the thirties, and spend most of the year in range. Then the dollar devaluation and worldwide usage pushed oil into the $70’s - $80’s range.]

Yes, I had good years predicting in 2008 and 2009, but there are no crystal ball that work all the time. This is based on experience, observation, and reading other peoples predictions. With all predictions, your results are affected by location, driving habits, weather and your mileage will vary…

Recession: We are seeing worldwide signs of recovery. Is it enough? There are other signs that are weaker. The US is not going to lead the recovery. The world has to pull the recovery. My major expectation is for slow growth of about 1% - 2%. There is also a significant chance for a double recession like the Great Depression. I put this at about 20% - 25%. If this happens it will be a tough year.

Interest Rates: Expect bond and borrowing rates to be raised. Creditors are going to demand more money to lend the Federal Government for spending. This is going to slow the economy toward the end of the year.

Stock Market: I suspect we are getting closer to a market top in the first quarter or mid year. We gain significantly since March 2009, and are possibly bubbly. The Fed may try to engineer a break in the rising market to keep interest rates low. Have my stop losses set and am monitoring.

Dollar: The slow down trend of the dollar has ended. There are so many concerns about the Euro and other currencies, believe the dollar will do well early in the year. Later in the year we may see Gold and Silver rising again despite the improvement of the dollar.

China: I expect the China boom to end late this year. They have a real estate bubble forming, and their leadership wants to slow down lending. They are trying to stimulate internal markets and keep their people employed.

Jobs: If you have a job, hang on to it until you find another. Unemployment is not improving, and may have bottomed. But the recovery for the job market will be slow.

Housing: Suspect the bottom to the real estate market to be closer, in 2011 or 2012. The over supply of home still has to be worked off the market. I expect prices to fall another 5% - 10% in 2010. Commercial real estate is falling and I don’t see the bottom yet.

Oil prices: There are a lot of possible scenarios for trouble this year, including a good possibly of needing to stop Iran from building nuclear bombs. If that happens or Iran grabs Iraqi oil fields, expect a short term spike. My major expectation is prices to stay in the $70’s - $80’s early in the year, and then increase into the $80 - $100 range by the end of the year.

Remember, we have lived through recessions before, and will survive. My prediction may be no more accurate than yours. But if these predictions happen, how will it affect your business?

Steve

Subscribe to:

Post Comments (Atom)

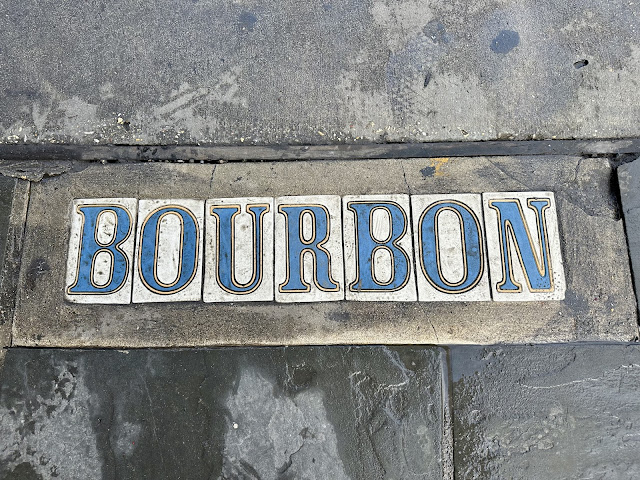

3:15 am attack on Bourbon Street, New Orleans this morning. This tragic attack killed 10 and injured ~35 including 2 police officers. Most...

-

Being self-employed had to learn how to network. Being naturally shy it was difficult at first until learning these secrets. 1. Act as ...

-

Siding with Apple that developing new software to crack one phone will be reused all over the world. No fan of terrorist, but other govern...

-

"Be at war with your vices; at peace with your neighbors, and let every New Year find you a better man." - Benjamin Franklin ...

No comments:

Post a Comment